UltraTrader Review 2025: Features, Costs, Pros & Cons

Trading is often described as one of the most psychologically demanding careers in the world. Unlike traditional jobs, you don’t have a steady paycheck, a boss giving you feedback, or colleagues to hold you accountable. Instead, your results are measured daily, sometimes hourly, in green and red numbers flashing across a screen.

This constant pressure creates two big challenges:

- Managing emotions – fear, greed, hesitation, and overconfidence often dictate decisions.

- Tracking performance – without proper data, most traders repeat the same mistakes.

That’s where trading journals come in. A journal helps you capture the “why” behind your decisions, not just the “what.” But in 2025, journaling is no longer about pen-and-paper notebooks or clunky Excel sheets. Digital trading journals have emerged as the new edge — combining automation, analytics, and integrations with brokers and exchanges. . Modern trading journals like UltraTrader do the heavy lifting of logging and reviewing trades, so traders can focus more on strategy and less on manual data entry.

UltraTrader is one of the latest entrants in this competitive space. It positions itself as an all-in-one crypto and multi-market trading journal, complete with features like paper trading, real-time tracking, portfolio management, and tax-ready exports. With a free forever plan and paid tier at just $12.50/month, it’s aggressively priced compared to industry veterans like TraderSync, TradeZella, and Tradervue.

But does UltraTrader really deliver on its promise to “refine your strategy and outperform the market”? In this deep-dive review, we’ll explore every feature, test its strengths and weaknesses, and compare it directly with the competition.

Is This the Best Trading Journal for Serious Traders?

Choosing the right trading journal can make the difference between repeating the same mistakes and building lasting consistency. UltraTrader is one of the newest platforms in this space, offering performance analytics, and broker integrations designed to help traders improve discipline and results. In addition, UltraTrader provides robust trading analysis capabilities, allowing users to evaluate performance metrics and outcomes in detail.

In this UltraTrader review, we’ll break down its features, costs, pros and cons, broker compatibility, and how it compares to other popular trading journals like TradeZella, TraderSync, and TraderVue. Our goal is to provide an objective look so you can decide if UltraTrader is the right tool for your trading journey.

What is UltraTrader?

What is UltraTrader?

UltraTrader describes itself as an all-in-one trading assistant, not just a logbook for your trades. It’s built for traders who want to:

- Track and analyze trades in real-time.

- Identify patterns in performance.

- Experiment risk-free through paper trading.

- Test and refine trading strategies using UltraTrader’s advanced tools.

- Journal experiences to reinforce discipline and growth.

- Automate trade imports from major brokers and crypto exchanges.

Where many older journals feel like glorified spreadsheets, UltraTrader modernizes the concept. Its clean interface, focus on automation, and emphasis on multi-market coverage (crypto, forex, indices, and stocks) give it a clear edge for today’s active traders.

Key Features of UltraTrader

UltraTrader is packed with features designed to streamline both crypto-native traders and traditional market participants. UltraTrader also offers advanced features for comprehensive trade analysis and automation. Let’s break these down.

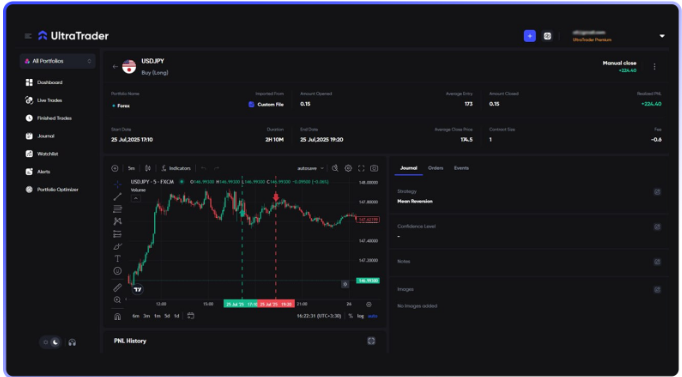

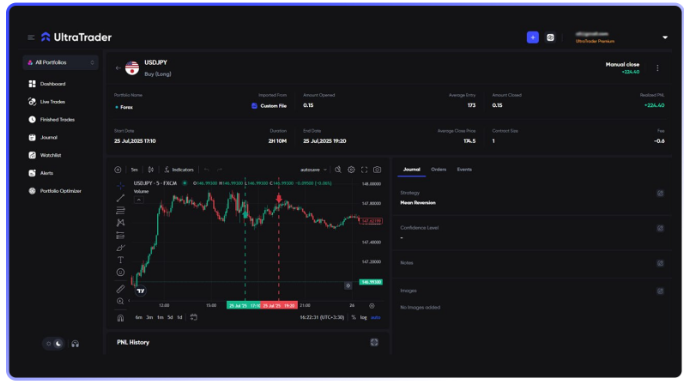

1. Trading Journal

At its core, UT offers a comprehensive trading journal. As a good trading journal, UltraTrader tracks and analyzes trading performance, allows users to tag trades for detailed performance assessment, and provides features that help improve trading strategies and discipline. Traders can:

- Log trades automatically via broker/exchange connections or CSV uploads.

- Add notes, screenshots, or personal reflections on performance.

- Review patterns such as average holding time, best/worst setups, and profitability across timeframes.

Why this matters: Journaling isn’t just about keeping records—it’s about building self-awareness. UT helps uncover tendencies like:

- Overtrading during low-volume hours.

- Consistently mismanaging stop losses.

- Performing better in specific market conditions (e.g., trending vs. ranging).

Unlike spreadsheet journaling, UltraTrader makes this process dynamic. You don’t just see numbers—you see patterns that shape actionable strategies.

2. Investment Tracker

UltraTrader doubles as a real-time portfolio tracker, giving you a bird’s-eye view of your holdings.

- Monitor performance across assets, brokers, and exchanges.

- Track both realized P&L and unrealized gains/losses.

- Consolidate multiple portfolios under one dashboard.

This feature appeals particularly to crypto traders juggling multiple wallets and exchange accounts. Instead of manually calculating, UT aggregates balances and trade histories seamlessly.

3. Paper Trading Simulator

One of UltraTrader’s standout features is its paper trading platform, which simulates real market conditions without financial risk.

You can:

- Test strategies using virtual capital.

- Analyze performance in a controlled environment.

- Build confidence before moving to live markets.

This is particularly valuable for:

- Beginners learning execution mechanics.

- Experienced traders testing new strategies.

- Traders moving from traditional assets into crypto, who need to understand volatility.

Unlike some journals that only track live trades, UT’s inclusion of paper trading makes it a learning and practice tool as well.

4. Automatic Sync with Supported Platforms

UltraTrader integrates directly with many brokers and exchanges, allowing automatic trade imports. Current supported platforms include:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- TradeLocker

- Bybit

- Binance

- Bitget

- Exness

- MEXC

- cTrader

- KuCoin

- OKX

Instead of wasting hours manually entering trades, you can connect accounts and let UT fetch your history. For traders juggling multiple venues, this is a game-changer.

5. Export for Tax Preparation

UltraTrader doesn’t directly prepare tax documents but allows users to export CSV files of their trades. This simplifies tax season by creating structured data that can be handed over to accountants or imported into tax software.

Key benefit: Whether you’re a crypto trader needing gain/loss tracking for IRS reporting or a stock trader calculating capital gains, this reduces the headache of compliance.

6. Price Alerts & Notifications

Traders can set up price alerts, ensuring they never miss a move. UltraTrader rapidly checks price changes so users don’t need to be glued to charts 24/7.

For swing traders or part-time traders, this feature is invaluable—it turns UT into a signal monitor as well as a journal.

7. Secure Infrastructure

UltraTrader emphasizes data security:

- All data is encrypted on secure servers.

- Trades and journals remain private by default.

Given that traders are uploading sensitive information (balances, performance metrics), this transparency around security builds trust.

8. Market Coverage

Unlike some journals that focus exclusively on stocks or crypto, UltraTrader supports multiple asset classes:

- Crypto

- Forex

- Indices

- Stocks

This makes it appealing to multi-asset traders, who can analyze everything in one place rather than juggling several tools.

Its audience is diverse:

- Day traders who need fast, clear feedback.

- Swing traders who want to evaluate medium-term strategies.

- Futures and forex traders who thrive on risk management.

- Crypto traders who need journal support across volatile markets.

Unlike older platforms such as TraderVue, UltraTrader emphasizes a modern user interface with streamlined workflows. That makes it approachable for newer traders, while still offering depth for more advanced users.

Key highlights:

- Automatic trade imports from supported brokers

- Notes, tags, and screenshots for each trade

- Custom dashboards that track performance patterns

AI Insights and Market Conditions

In today’s fast-paced markets, understanding your trading performance and adapting to changing market conditions is absolutely essential for any serious trader. UltraTrader equips users with advanced analytics that go beyond basic trade journaling, allowing you to analyze your trading habits, identify areas for improvement, and refine your trading style for a more profitable strategy.

With UltraTrader, you can import trades from multiple brokers and platforms, making it easy to consolidate your trading history and perform in-depth trade analysis. The platform’s dashboards and custom filters help you break down your trades by strategy, asset class, or market conditions, so you can see exactly where your trading edge lies. Whether you’re tracking your win rate, profit factor, or risk limits, UltraTrader’s analytics provide actionable insights to help you manage risk and build confidence in your approach.

While UltraTrader focuses on robust analytics and clear reporting, the trading journal industry is rapidly evolving with the introduction of AI-powered features. Platforms like TradesViz are leading the way with AI insights that automatically analyze your past trades, highlight patterns in your trading habits, and suggest ways to optimize your performance. These AI-powered insights can be a game-changer for traders looking to stay disciplined, adapt to new market conditions, and develop a consistently profitable strategy.

For traders who want to stay ahead, leveraging advanced analytics—whether through UltraTrader’s comprehensive dashboards or emerging AI-powered tools—can make the difference between average results and true trading success. By regularly reviewing your trades, analyzing your performance, and adapting your strategies, you’ll be better equipped to manage risk, capitalize on market opportunities, and achieve your trading goals.

Benefits of UltraTrader

UltraTrader’s value lies in how it combines data with trader behavior.

Key benefits include:

- Comprehensive Performance Analytics

- Tracks win rate, expectancy, risk-reward ratios, and more.

- Custom filters allow traders to evaluate performance by time of day, strategy, or market.

- Tracks win rate, expectancy, risk-reward ratios, and more.

- Automation & Broker Integration

- Trade imports save hours of manual logging.

- Reduces human error, ensuring accurate records.

- Trade imports save hours of manual logging.

- Customizable Journals

- Users can tag trades, attach screenshots, and categorize setups.

- Useful for traders refining specific strategies.

- Users can tag trades, attach screenshots, and categorize setups.

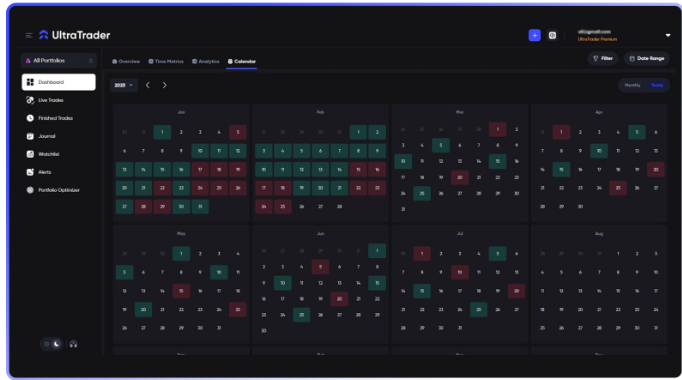

- Progress Tracking

- Month-over-month dashboards highlight consistency.

- Helps traders see gradual improvement, which can build confidence.

- Month-over-month dashboards highlight consistency.

- Risk Management Insights

- Reports on average loss size vs. gain size.

- Allows traders to spot if they’re cutting winners too early or letting losers run.

- Reports on average loss size vs. gain size.

Why it matters: Trading is not about single trades; it’s about patterns. UltraTrader helps reveal those patterns, making it a valuable resource for disciplined traders who want long-term growth.

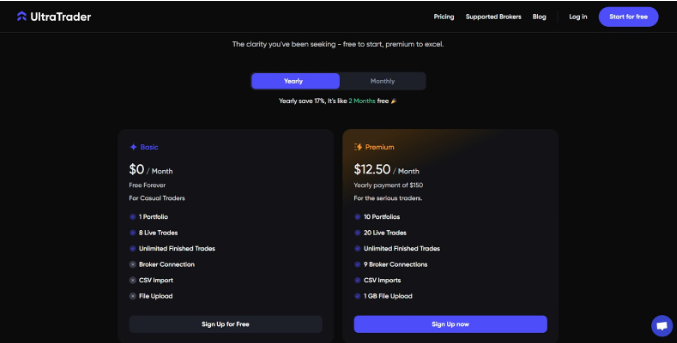

How Much Does UltraTrader Cost?

UltraTrader uses a subscription-based model, with tiered pricing depending on features. While exact figures can vary, the structure typically looks like this:

- Basic Plan (FREE!!): Manual imports, core journaling, and basic analytics, unlimited finished trades.

- Premium Plan (~$12.50/month): Full analytics suite, psychological journaling, and advanced reporting, broker connections, track live trades, imports and uploads

Discounts are often available for annual billing, which can save traders around 15–20%.

When compared with competitors:

- TradeZella sits around $49–59/month.

- TraderSync offers plans starting closer to $20/month

- TraderVue plans range from $29.95 – $49.95/month with 80+ broker integrations

For serious traders, UltraTrader’s cost is below the going market price and is a great value. The key question isn’t “Is it cheap?” but “Does it provide value?” For anyone trading with real capital, the ability to correct recurring mistakes can far outweigh the subscription price.

Is UltraTrader Worth It?

Yes — UltraTrader is worth it for many traders, especially if you want a modern, affordable, and beginner-friendly trading journal with paper trading included.

Here’s why:

- Free forever plan: Unlike TraderSync (7-day trial), Tradervue (7-day trial), or TradeZella (no free plan), UltraTrader gives you a $0 Basic tier that’s actually functional — perfect for beginners.

- Affordable premium: At just $12.50/month (billed annually), UltraTrader’s Premium plan is a fraction of what TraderSync ($18–40/month), Tradervue ($30–50/month), or TradeZella (~$49+) charge.

- Paper trading built-in: This is rare among journals. You can practice with virtual capital, test strategies, and build confidence before going live.

- Strong broker support: It integrates with major platforms (MT4, MT5, TradeLocker, Bybit, Binance, Bitget, Exness, MEXC, cTrader, KuCoin, OKX) — covering both crypto and forex traders better than most competitors.

- User-friendly: The design is clean, mobile-ready (Google Play + App Store), and approachable, unlike older tools like Tradervue that can feel dated.

- Weaknesses: It doesn’t have AI coaching like TraderSync, advanced backtesting like TradeZella, or 80+ integrations like Tradervue. Serious data-driven or professional traders may eventually outgrow it.

UltraTrader Across Markets

UltraTrader is designed to be versatile across asset classes:

- Futures: Strong analytics for contracts, margin use, and tick-based results.

- Forex: Works seamlessly with major brokers; supports trade tagging by pair and session.

- Stocks: Useful for both day traders and swing traders; auto-imports from major equity platforms.

- Crypto: Provides journal support, though integration with crypto exchanges may be limited compared to equities and forex.

Where it shines most is in futures and forex, where risk management is critical and journaling can reveal costly tendencies. For stock and crypto traders, the benefits are still strong, though some may prefer competitor platforms if they need highly specialized broker integrations.

Who Owns UltraTrader?

UltraTrader was founded by a team of traders and developers who saw gaps in existing journaling software. While the company isn’t as publicly known as competitors like TradeZella, its mission is clear: make journaling less tedious and more actionable.

Ownership and leadership details are less visible compared to platforms with influencer founders. This has pros and cons: the platform is less about personal branding and more about functionality, but it may feel less “transparent” for users who want to know the people behind the product.

- Pros: Neutral brand, tool-focused

- Cons: Less transparency into ownership and leadership

How UltraTrader Works

UltraTrader follows a straightforward workflow:

- Connect a Broker or Upload Trades

- Direct API connections allow auto-imports.

- Manual CSV uploads are also available.

- Direct API connections allow auto-imports.

- Organize & Categorize

- Trades are automatically logged into a journal.

- Users can tag setups, add notes, or attach screenshots of charts.

- Trades are automatically logged into a journal.

- Review Analytics

- Dashboards summarize key metrics like P/L, win rate, expectancy, and max drawdown.

- Filters allow traders to drill down by ticker, time of day, or strategy.

- Dashboards summarize key metrics like P/L, win rate, expectancy, and max drawdown.

- Iterate & Improve

- Traders adjust strategy based on insights.

- Monthly/quarterly reports track consistency.

- Traders adjust strategy based on insights.

This workflow transforms journaling from a chore into a strategic habit.

Broker Integrations

UltraTrader supports several popular brokers, MetaTrader 4/5, Tradelocker, Bybit, Binance, IB. Direct integrations are expanding, but not all brokers are covered yet — meaning some users may need to rely on CSV uploads.

Compared to competitors:

- TradeZella has robust broker integrations out of the box.

- TraderSync supports many platforms but can feel clunky.

- TraderVue is flexible but outdated in design.

UltraTrader’s integrations are growing, but this is one area where it still has room to expand. Traders should confirm broker compatibility before committing.

UltraTrader vs Other Trading Journals

What is the Best Trading Journaling Software?

There isn’t a one-size-fits-all answer. The “best” journal depends on your trading style, budget, and preferred features. Here’s how the top platforms stack up:

- UltraTrader – Best for traders who want a balance of data and well suited to crypto traders.

- TradeZella – Excellent for sleek design and easy integrations; strong community presence.

- TraderSync – Flexible and affordable; solid for budget-conscious traders.

- TraderVue – Established and reliable, though the interface feels outdated.

If you value ease of use, UltraTrader is hard to beat. If broker compatibility is your top priority, TradeZella may be stronger. For those who want a low-cost option, TraderSync fits. Veterans who don’t mind an older UI may stick with TraderVue.

Here’s how UltraTrader compares against its main competitors:

UltraTrader vs Competitors

UltraTrader vs TradeZella

- Both offer sleek dashboards and auto-import features.

- TradeZella benefits from brand recognition through Umar Ashraf, while UltraTrader feels more “neutral.”

- Verdict: Choose UltraTrader if journaling discipline is your focus; choose TradeZella if you want an influencer-backed platform with polished integrations.

UltraTrader vs TraderSync

- TraderSync is affordable and long-standing.

- UltraTrader has a more modern interface.

- Verdict: TraderSync suits budget traders; UltraTrader suits traders who want depth.

UltraTrader vs TraderVue

- TraderVue is older but well-tested.

- UltraTrader is newer, smoother, and easier to use.

- Verdict: TraderVue for veterans who value legacy stability; UltraTrader for traders who want modern features.

Verdict: UltraTrader’s biggest advantage is its free option, crypto-first focus, paper trading, real-time alerts, secure journaling.

Pros & Cons of UltraTrader

Pros

- Modern, user-friendly interface

- Strong performance analytics with filters

- Auto-imports from major brokers (IB, TOS, MT4/5)

- Flexible tagging and journaling options

- Clear progress tracking for consistency

Cons

- Subscription may feel steep for casual traders

- Broker integrations less extensive than TradeZella

- Newer platform with smaller community base

- Limited transparency around ownership/founders

Key Benefits:

- Performance Analytics – Track win rates, expectancy, and risk/reward across setups.

- Automation – Save time with broker auto-imports and reduced manual entry.

- Custom Journaling – Add screenshots, notes, and strategy tags to refine setups.

- Progress Reports – Monthly dashboards highlight consistency and growth.

- Risk Insights – Review average loss vs. gain size to tighten risk management.

Why it matters: Trading success is built on patterns. UltraTrader helps reveal those patterns.

Who Should Use UltraTrader?

- Crypto traders: Especially those active on Binance, Bybit, or KuCoin.

- Beginner traders: Thanks to free forever access and paper trading.

- Multi-asset traders: Those juggling forex, indices, and stocks alongside crypto.

- Traders on a budget: Premium at $12.50/month is cheaper than most competitors.

UltraTrader may not replace advanced AI-driven journals like TraderSync for professional prop firm traders, but for most independent and retail traders, it provides an excellent balance of features and affordability.

Final Verdict

UltraTrader delivers on its promise as the modern trading journal for ambitious traders. With its free forever Basic plan, affordable Premium option, and features like paper trading, auto-sync integrations, tax-friendly exports, and secure data storage, it fills a gap in the market—especially for crypto-focused and multi-asset traders.

While it doesn’t yet have the AI insights or replay depth of competitors like TraderSync or TradeZella, its simplicity, accessibility, and cost-effectiveness make it one of the most attractive trading journals in 2025.

If you’re a trader looking to take your performance seriously without spending $40+ a month, UltraTrader is a strong choice.

UltraTrader is a modern trading journal that blends deep analytics with trade tracking, along with its easy to use interface making it a smart choice for traders who want to turn data into consistency as a novice or experienced trader.

Its strengths include:

- Advanced analytics

- Modern interface

- Broker integrations

Its weaknesses include:

- Subscription cost may feel high for casual traders

- Broker support isn’t as broad as some competitors

Overall, UltraTrader is worth considering for any trader serious about long-term improvement. Journaling is the habit that separates amateurs from professionals, and UltraTrader makes it easier to stick with that habit.

Call to Action

At Maverick Trading, we believe tools like UltraTrader can help traders improve, but mentorship and community support are just as important.

Ready to grow your trading discipline? Book a call with Maverick today.