Using Currency Strength Meter to Profit in Forex Trading

Are you feeling overwhelmed by the sheer number of currency pairs in Forex trading, struggling to pinpoint which ones offer the strongest trends or the best trading setups? Many traders grapple with identifying the underlying strength or weakness of individual currencies, often leading to missed opportunities or trades against the prevailing flow.

What if there was a tool that could instantly reveal which currencies are gaining power and which are losing it, simplifying your decision-making and enhancing your trading accuracy? This post will demystify the Currency Strength Meter (CSM), explaining what it is, how it works, and most importantly, how you can leverage this powerful tool to identify high-probability trading opportunities in the dynamic Forex market.

Intro to Forex Trading

Forex, or foreign exchange, trading involves the simultaneous buying of one currency and selling of another. It’s the largest financial market in the world, with trillions of dollars exchanged daily. The forex market is characterized by high liquidity, with liquidity flows constantly shifting as traders buy and sell currencies. Traders participate to profit from the fluctuations in exchange rates between different currencies. For instance, if you believe the Euro will strengthen against the US Dollar, you would buy EUR/USD. The market is always quoted in pairs, such as EUR/USD, GBP/JPY, or AUD/CAD, because you’re always exchanging one currency for another.

This constant interplay of global economies and financial policies makes Forex both exciting and complex. Monitoring liquidity flows can help traders understand which currencies are likely to experience significant movements. Understanding which individual currencies are gaining or losing ground relative to others is crucial for success in this intricate market.

Understanding Currency Strength

In Forex, currency strength refers to how robust or weak a particular currency is in relation to a basket of other major currencies. A currency gains strength when there’s high demand for it, typically driven by positive economic data, strong interest rate outlooks, political stability, or increased investor confidence. Conversely, a currency weakens when there’s low demand, often due to poor economic performance, lower interest rates, political instability, or decreased investor confidence.

How to tell which currency is stronger?

Traders use various methods to determine which currency is strong in the market. For example, if EUR/USD is rising, it could be because the Euro is strengthening, or the US Dollar is weakening, or both. To truly understand which currency is stronger, you need to assess its performance against multiple other currencies.

Traditionally, traders might look at several pairs: EUR/USD, EUR/JPY, EUR/GBP, and so on, to see how the Euro is performing across the board. This manual comparison can be time-consuming and prone to misinterpretation, especially in fast-moving markets. Currency strength is typically measured by analyzing a currency’s performance against a basket of other currencies. This is where tools like a Currency Strength Meter become invaluable, as they automate this complex comparison and help traders determine the current strength or weakness of specific currencies.

What is a Currency Strength Meter?

A Currency Strength Meter (CSM) is a trading tool, often presented as an indicator or dashboard, that visually represents the relative strength or weakness of major individual currencies in real-time. A currency strength indicator is a technical tool that provides a quick visual guide to the relative strength of currencies. Instead of just showing the relationship between two currencies (like a typical Forex pair), a CSM analyzes how each major currency is performing against all the other major currencies it’s commonly paired with.

For example, a CSM might analyze the USD against EUR, JPY, GBP, AUD, CAD, CHF, NZD, as well as the Swiss Franc, Swedish Krona, Canadian Dollar, and British Pound. It then assigns a score or a visual indicator (like a bar, line, or numerical value) to the USD, showing its overall strength compared to the entire basket. The meter allows traders to compare the performance of more pairs and forex pairs than traditional indices, providing a broader and more accurate assessment. This allows traders to quickly identify which currencies are the strongest (e.g., scoring 8 out of 8) and which are the weakest (e.g., scoring 1 out of 8) at any given moment. This graphical representation helps traders quickly interpret market conditions and instantly cuts through the complexity of individual currency pairs, giving you a clear birds-eye view of the market’s underlying momentum.

What are the benefits of using a currency strength meter in Forex trading?

Using a Currency Strength Meter offers several significant advantages for Forex traders:

- Identifies Strong Trends: A CSM helps you spot which currencies are trending strongly, either up or down, across the entire market, not just in one pair. This is critical for trend-following strategies.

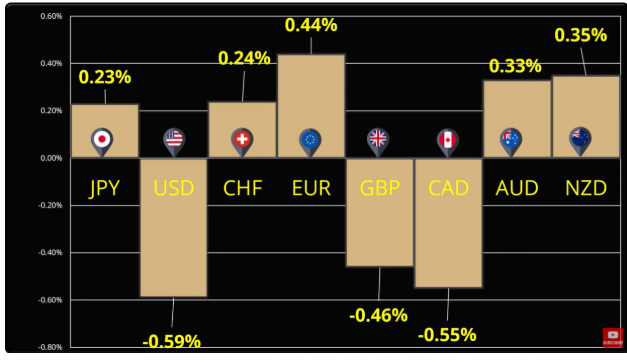

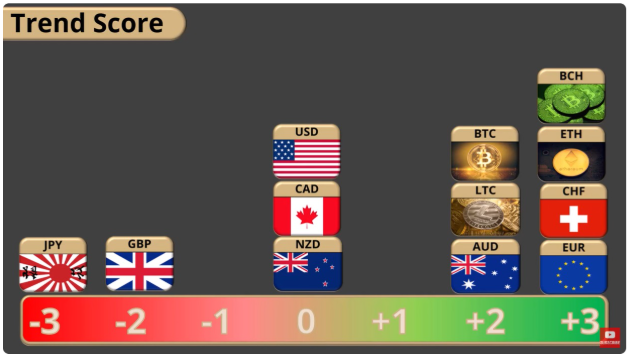

Image of trend score; strongest vs weakest currencies

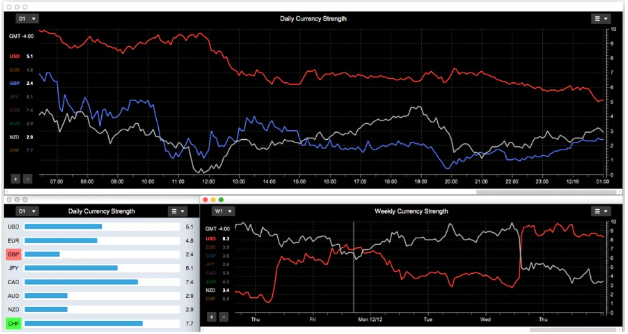

- Provides Access to Both Live Updates and Historical Data: The CSM app provides access to both live updates and historical data, allowing traders to analyze currency strength across various timeframes and time frames for better decision-making.

- Average Gain Calculated Across Multiple Pairs and Timeframes: The average gain of each currency is calculated using data from multiple pairs and timeframes, offering a comprehensive view of currency strength and market trends.

- Pinpoints Best Pairs for Trading: By matching a strong currency against a weak one, you can identify pairs with the highest potential volatility and clearest directional bias, leading to more impactful trades. For instance, if the US Dollar is very strong and the Japanese Yen is very weak, USD/JPY might present a high-probability long opportunity, leveraging the underlying momentum. You can find more insights on US Dollar strength to complement this.

- Avoids Ranging or Consolidating Pairs: Conversely, if two currencies are of similar strength, their pair is likely to be ranging or consolidating, which can be difficult and less profitable to trade. A CSM helps you avoid these choppy markets.

- Confirms Trading Ideas: If you have a trading idea based on other analysis (e.g., a technical pattern or fundamental news), a CSM can provide confirmation by showing if the underlying currencies are indeed moving in the anticipated direction.

- Improves Risk Management: By entering trades with clear directional bias, you potentially reduce the likelihood of whipsaws and false breakouts, which helps in better managing your risk per trade.

- Simplifies Multi-Currency Analysis: Instead of manually comparing numerous charts, the CSM provides an immediate visual summary, saving time and reducing mental fatigue. This allows you to focus on executing your strategy rather than exhaustive analysis.

What is the difference between a currency index and a currency strength meter?

While both currency indexes and currency strength meters aim to measure currency performance, they do so with different methodologies and serve slightly different purposes:

- Currency Index (e.g., US Dollar Index – DXY):

- A currency index measures the value of a single currency against a fixed basket of major foreign currencies. The most famous example is the US Dollar Index (DXY), which tracks the USD against EUR, JPY, GBP, CAD, CHF, and SEK.

- The composition of the basket is usually fixed and weighted. For example, the Euro typically has the largest weighting in the DXY.

- The index value is calculated based on the weighted average of its component currencies, providing a quantitative measure of the currency’s performance relative to others.

- It functions like a traditional stock index, showing the absolute performance of that one currency against its defined basket over time. You can view its historical charts and trends.

- It’s generally used for higher-level macroeconomic analysis and understanding long-term trends or the overall sentiment towards a specific currency.

Currency Strength Meter (CSM):

- A CSM measures the relative, real-time strength of multiple individual currencies against each other. It doesn’t track one currency against a fixed basket but rather compares all major currencies against each other at that precise moment.

- It provides a dynamic, often fluctuating, snapshot of which currencies are currently the strongest and weakest, often presenting scores or bars for each.

- It’s primarily used for identifying short-to-medium term trading opportunities and confirming entry/exit signals.

- Think of it as a competitive ranking: “Which currency is winning the race right now, and which is losing?”

In essence, a currency index gives you a historical and often broader view of one currency’s performance, while a Currency Strength Meter gives you a dynamic, real-time comparison of multiple currencies against each other for immediate trading decisions. Both tools can be used to analyze currency performance at a given datetime, allowing for precise historical comparison and market analysis.

How Trading with a Currency Strength Meter Works

A currency strength meter works by comparing the performance of different currencies over a specific time frame, using price changes and pairing calculations to assess their relative strength.

A Currency Strength Meter works by performing complex calculations on the price movements of multiple currency pairs simultaneously. While the exact algorithms can vary between different CSM tools, the general principle involves:

- Collecting Real-time Price Data: The CSM continuously pulls live price feeds for all major currency pairs (e.g., EUR/USD, GBP/JPY, AUD/CAD, USD/CHF, etc.).

- Analyzing Individual Currency Movements: For each major currency (e.g., USD, EUR, JPY, GBP, AUD, CAD, CHF, NZD), the meter assesses its performance across all the pairs it’s part of. For instance, to calculate the strength of the USD, it would look at USD/JPY, EUR/USD, GBP/USD, AUD/USD, USD/CAD, and USD/CHF.

- Calculating Momentum/Velocity: It often incorporates elements of momentum or velocity. A sudden sharp move in a pair (e.g., EUR/USD skyrocketing) will indicate a strong directional push, which contributes to the strength score of the gaining currency (EUR) and detracts from the losing one (USD).

- Assigning Scores or Visuals: Based on these calculations, each currency is assigned a numerical score (e.g., from 0 to 8, or 0 to 100), a bar that grows or shrinks, or a color-coded indicator (e.g., green for strong, red for weak). The meter determines the relative strength of each currency using real-time data, making it easy for traders to identify which currencies are currently strong or weak.

- Timeframe Sensitivity: Most CSMs allow you to select a timeframe (e.g., M5, M15, H1, H4, Daily). This is crucial because a currency might be strong on a 15-minute chart (short-term momentum) but weak on a daily chart (long-term trend). This flexibility allows traders to use the meter for various trading styles, from scalping to swing trading. The meter essentially synthesizes a large amount of raw price data into an easily digestible visual format, helping traders quickly grasp the underlying market dynamics without manually analyzing numerous charts.

- By analyzing these metrics, traders can use the currency strength meter to help predict currency movements and make more informed trading decisions.

How can I use the Forex strength meter to identify trading opportunities?

The Forex strength meter is a powerful tool for identifying high-probability trading opportunities by helping you “marry the strong with the weak.” Here’s how you can leverage it:

- Identify the Strongest and Weakest Currencies:

- Look for currencies with the highest strength scores (e.g., 7 or 8 out of 8) – these are the “bulls.”

- Simultaneously, identify currencies with the lowest strength scores (e.g., 0 or 1 out of 8) – these are the “bears.”

- Formulate High-Probability Pairs:

- The most profitable opportunities often arise when you pair a very strong currency against a very weak one.

- Example 1: Strong vs. Weak: If the JPY is extremely weak (score 0-1) and the EUR is very strong (score 7-8), the EUR/JPY pair is likely to be in a strong uptrend. This would present a potential long (buy) opportunity.

- Example 2: Divergence: If two related currencies are showing opposing strengths (e.g., AUD very strong, NZD very weak), the AUD/NZD pair might offer a high-probability trade.

- Confirm with Your Trading Strategy:

- The CSM is a confirmation tool, not a standalone strategy. Once you identify a high-probability pair, switch to its chart.

- The meter helps traders decide when to enter or exit trades based on currency strength signals, supporting your decision-making process.

- Look for your preferred technical analysis setups:

- Trend Following: Confirm that the pair’s chart indeed shows a strong, clear trend in the direction indicated by the CSM.

- Breakouts: The strength meter can confirm momentum behind a breakout of a key support or resistance level.

- Retracements: If a strong currency pair retraces, the CSM can help you confirm if the underlying currency strength is still intact for a continuation.

- Consider incorporating these insights into your 5 best Forex strategies for beginners.

- Always check the relevant timeframe on your CSM to match your trading style. A scalper will use lower timeframes (M5, M15), while a swing trader will use higher ones (H4, Daily).

- Avoid Consolidating or Ranging Pairs:

- If two currencies have similar strength scores (e.g., both are 4 or 5), their corresponding pair is likely in a range, with sideways movement in currency prices and no clear direction. The CSM helps you filter out these less favorable trading environments, saving you from frustrating whipsaw trades.

- Use for Entry and Exit Management:

- The CSM can also provide clues for managing active trades. If the strength balance starts to shift, indicating the strong currency is weakening or the weak one is strengthening, it might be a signal to tighten stops or consider taking partial profits.

By integrating the Currency Strength Meter into your trading routine, you can gain a deeper, real-time understanding of market dynamics, enabling you to pick clearer trends and higher-probability setups, thereby increasing your trading efficiency and potential profitability.

Summary: Currency Strength Meter (CSM)

In the intricate world of Forex trading, understanding the underlying strength and weakness of individual currencies is paramount for making informed decisions. The Currency Strength Meter (CSM) emerges as an invaluable tool, offering a dynamic, real-time visual representation of how each major currency performs against its peers. Unlike currency indexes that track a single currency against a fixed basket, the CSM provides a granular, comparative snapshot, instantly revealing the strongest and weakest currencies at any given moment.

Utilizing a CSM empowers traders to pinpoint the most promising currency pairs by “marrying the strong with the weak,” thereby identifying high-probability trends and avoiding choppy, ranging markets. While not a standalone strategy, the CSM serves as a powerful confirmation tool, enhancing existing trading strategies and improving overall risk management. By integrating this dashboard into your analytical process, you can streamline multi-currency analysis, gain deeper market insights, and significantly boost your efficiency in navigating the ever-changing Forex landscape.

Ready to master advanced Forex tools and refine your trading edge?

Understanding currency strength is just one piece of the puzzle. At Maverick Trading & Currencies, our professional traders and comprehensive training can help you integrate powerful tools like the Currency Strength Meter into a robust, disciplined trading strategy.

Book a Free Consultation Call with Maverick Trading & Currencies Today!