The Ultimate Guide to Bull Flag Patterns: Identify and Trade Breakouts

Have you ever jumped into a trade right as momentum died, leaving you bag-holding a stock that looked perfect? It’s one of the most frustrating parts of trading. You spot a strong uptrend, the price dips a little, and you think it’s your moment to buy in—only to watch it consolidate sideways and collapse. If you’ve been there, you’re not alone. Most traders misread these setups because they don’t fully understand one of the most powerful continuation patterns in technical analysis: the bull flag.

Here’s the good news: once you master the bull flag pattern, it becomes a reliable tool for identifying high-probability trade setups with clear entries and well-defined risk. In this post, we’re going to unpack the bull flag pattern from top to bottom. You’ll learn how to spot it, why it works, how to avoid common mistakes, and most importantly, how to trade it like a pro.

Bull Flag Pattern: A Trader’s Guide to Spotting Explosive Breakouts

Introduction to Chart Patterns

Chart patterns are the language of the market. Chart patterns are a key part of technical analysis, which involves studying price movements, chart formations, and indicators to predict future trends. They give structure to price movements and provide traders with predictive tools for future price action. Patterns are a type of price pattern that can signal reversals, continuations, and the strength or weakness of a trend. Traders use price charts to visually identify these patterns across different timeframes.

What Are Trading Flag Patterns?

Flag patterns are a type of pattern and a subset of continuation patterns. As flag formations, they resemble a flag on a pole, with a sharp price movement (the flagpole), followed by a consolidation (the flag). These patterns occur when the market pauses after a significant move before continuing in the same direction. The bullish version is known as the bull flag chart pattern, often referred to as bullish flags, while the bearish version is called a bear flag. Bull flag patterns are among the most recognized flag formations in technical analysis. Flags can be bullish or bearish, depending on the direction of the preceding trend.

Understanding the Bullish Flag Pattern

What Does a Bull Flag Pattern Mean?

A bull flag chart pattern is a classic bullish continuation pattern that forms after a sharp price increase, known as the flagpole, which marks the initial uptrend or prior uptrend. Following this strong upward move, the price consolidates in a sideways to slightly downward manner, forming the flag. This consolidation is typically characterized by declining volume, signaling a temporary pause in the market. When the price breaks above the upper resistance of the flag, it often leads to a powerful continuation of the previous uptrend.

In simple terms, a bull flag shows that buyers are taking a breather, but they haven’t left the party.

Anatomy of a Bull Flag

- Flagpole: A steep, nearly vertical price rise fueled by high volume , forming the initial part of the bull flag formation.

- Flag: A downward-sloping or horizontal rectangle formed by price consolidation, typically accompanied by lower volume compared to the flagpole.

- Breakout: A price movement above the breakout level at the upper boundary of the flag, ideally confirmed by higher volume.

What Is the Psychology of the Bull Flag?

The bull flag captures a psychological moment in the market:

- Buyers drove the initial move (flagpole).

- Profit-takers and shorts entered during consolidation (flag).

- New buyers jump in after breakout confirmation.

This battle between short-term sellers and long-term bulls builds pressure. When that pressure is released with a breakout, it can lead to explosive moves. The pattern suggests that the trend is likely to continue upward following the breakout.

Let’s break this down further:

- During the flagpole, the dominant emotion is optimism or euphoria, driven by news, earnings, or momentum. Traders rush in, fueling rapid gains.

- The flag phase introduces doubt—is the move over, or just pausing? Sellers begin to take profits. Bears try to short. Meanwhile, smart money starts positioning quietly.

- Once consolidation tightens and volume dries up, tension builds. At the moment of breakout, FOMO kicks in—retail and institutional buyers alike pile in, driving prices sharply higher.

What Happens After the Bull Flag?

If the pattern is valid, the price often moves an equal distance to the length of the flagpole, projected from the breakout point. For example, if the flagpole was a $5 move, the post-breakout target would also be $5 higher.

The pattern completes when the price breaks out above the consolidation zone, confirming the continuation of the uptrend and validating the bullish flag pattern.

What Is the Success Rate of the Bull Flag Pattern?

According to research from Bulkowski and other market pattern analysts, bull flags have a historical success rate of about 67% when traded correctly. However, context matters: time frame, volume, and market conditions can affect the pattern’s reliability.

What Is a Bull Flag Pattern Invalidation?

Invalidation occurs when the price:

- Breaks down below the lower boundary of the flag.

- Falls below the flagpole’s starting point.

- Fails to break out within a reasonable number of candles.

Bull flag patterns fail when the correction is too deep, such as exceeding 50% of the flagpole, or when a false breakout occurs.

False breakouts and false signals can mislead traders, so it is important to confirm breakouts with volume and proper timing. If price falls below key support levels, it is a sign to exit or reassess the trade.

These signals indicate a loss of momentum or a possible reversal.

What Is the Best Time Frame for a Bull Flag?

Bull flags appear on all time frames, but the most reliable setups occur on:

- 4-hour and daily charts for swing traders.

- 15-minute and hourly charts for intraday traders.

Traders use price charts of various timeframes to spot bull flag patterns.

Higher time frames often yield stronger and more predictable breakouts.

Flag Trading Techniques

Flag trading techniques are essential tools for traders looking to capitalize on the powerful moves that flag patterns can signal. By mastering the art of identifying and trading flag patterns, traders can better predict the future direction of a stock price and ride the momentum of prevailing trends.

Here are some of the most effective flag trading techniques to help you make the most of these classic chart patterns:

- Spotting the Flag Pole: The first step in trading flag patterns is to identify the flag pole—a sharp, vertical rise in price that sets the stage for the pattern. This strong initial trend, often accompanied by high volume, signals that buyers (or sellers, in the case of bear flags) are in control. Recognizing the flag pole helps you determine the direction and strength of the move you’re looking to trade.

- Recognizing the Flag Formation: After the flag pole, look for a brief consolidation period where the price moves sideways or slightly against the prevailing trend. This flag portion is typically marked by a tight range and declining volume, reflecting a pause as the market digests the sharp rise. The flag formation should be well-defined, making it easier to spot potential breakout points.

- Waiting for the Breakout: One of the most critical flag trading techniques is patience. Rather than jumping in during the consolidation phase, wait for the price to break above (or below, for bear flags) the flag’s boundary. A decisive price break signals that the consolidation is over and the trend is likely to resume. This breakout point is often the ideal entry point for a trade.

- Using Volume as Confirmation: Volume plays a crucial role in validating flag patterns. A sharp rise in volume during the flag pole, followed by lower volume during the flag, suggests a healthy trend. When the price breaks out of the flag pattern, a surge in volume confirms the move and increases the likelihood of a successful trade. Conversely, weak volume on the breakout may signal a false move or a lack of conviction.

By combining these flag trading techniques—identifying the flag pole, recognizing the flag, waiting for a breakout, and confirming with volume—you can improve your ability to trade flag patterns with confidence. Whether you’re trading bull flags or bear flags, these strategies help you spot high-probability setups and manage risk effectively in trending markets.

How to Trade a Bull Flag Step-by-Step

Now that you can recognize the bull flag, let’s dive into the mechanics of trading it.

Step 1: Identify the Flagpole

Look for a sharp,price rise, a nearly vertical move upward on strong volume. This is your flagpole—the stronger and steeper, the better. Avoid patterns without a clear flagpole.

Step 2: Wait for the Flag to Form

The price consolidates sideways or slightly downward, forming a flag pattern as the price consolidates within parallel trendlines, usually with declining volume. Use trendlines to draw the upper and lower bounds of the flag.

Step 3: Monitor Volume During Consolidation

Volume should taper off as the flag forms. This signals a pause in buying, not a reversal. If volume remains high or spikes downward, reconsider the setup. A breakout above the trendline or resistance level should be confirmed by higher volume to validate the move.

Step 4: Entry Trigger—Breakout Confirmation

Your ideal entry is triggered when the price breaks above the breakout level, which is the upper boundary of the flag, on increased volume. This move is known as a bull flag breakout. Traders often enter a long position at this point. Wait for a closing candle above resistance, not just a wick or intrabar spike.

Step 5: Set Your Stop-Loss

Place your stop just below the lower boundary of the flag. If you want to be more conservative, place it just below the lowest point of the flag consolidation.

Using stop-loss orders is one of the essential risk management techniques when trading bull flags, as it helps limit potential losses and manage risk effectively.

Step 6: Define Your Profit Target

Use the measured move technique: take the height of the flagpole and project it upward from the breakout point. That becomes your first take profit level. Traders may set multiple take profit levels to scale out of the trade as the price moves in their favor. Clearly defined exit points, such as these take profit levels, help maximize profits and minimize losses.You can scale out partially or trail your stop to lock in gains.

Step 7: Position Sizing and Risk Management

Calculate your position size based on your account size and acceptable risk (e.g., 1-2% per trade).When planning your trade, always consider the risk to reward ratio—aim for a favorable ratio, such as 2:1 or better, to ensure the potential reward justifies the risk. Don’t overleverage just because the pattern looks great.

This structured approach takes emotion out of the equation and makes the bull flag a repeatable, disciplined trade setup

The Bull Flag Pattern vs. Other Patterns

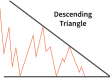

What Is the Difference Between a Bear Flag and a Bull Flag?

- Bull Flag: Forms after an uptrend; signals continuation higher.

- Bearish Flag Pattern: Forms after a downtrend; signals continuation lower and indicates the potential for further decline in price.

They have similar shapes but opposite implications.

What Is the Difference Between a Bull Flag and a Downtrend?

At first glance, a bull flag can look like a downtrend. The difference lies in:

- Context: A bull flag follows a strong upward move, while bear flags typically form in bearish markets after a strong downward move.

- Volume: Volume should decrease during the flag and spike at breakout.

- Duration: Flags are short-term pauses, not sustained downward trends.

What Is the Difference Between a Double Top and a Bull Flag?

- Double Top: A reversal pattern with two failed highs at the same level.

- Bull Flag: A breakout pattern and continuation pattern with temporary consolidation.

A double top warns of a trend ending, while a bull flag indicates it’s taking a breather before continuing.

Avoiding Common Bull Flag Mistakes

Effective trading strategies, including bull flag trading strategies, can help traders avoid common pitfalls and improve their results. Mastering bull flag trading and recognizing reliable flag formations—such as bull flags and bear flags—are key to consistent success.

Even seasoned traders fall into bull flag traps. Here are the top pitfalls to avoid:

- Entering Too Early: Wait for confirmation—a breakout with volume.

- Ignoring Volume: A low-volume breakout is often a fakeout.

- Mistaking a Downtrend for a Flag: Look for the strong flagpole. No flagpole, no flag.

- Overlooking Market Conditions: Bull flags work best in trending markets, not choppy ones.

- No Risk Plan: Always set a stop-loss below the flag’s low.

Avoiding these mistakes can drastically increase your win rate with the pattern and help you implement more effective trading strategies.

Conclusion

The bull flag pattern is one of the most powerful tools in a trader’s arsenal. As one of the most reliable price patterns and flag formations in technical analysis, the bull flag formation offers clear entry and exit signals, built-in risk management, and a high probability of success when executed correctly.

To recap:

- A bull flag forms after a strong move up and shows temporary consolidation.

- It’s a continuation pattern, not a reversal.

- Success hinges on confirmation—volume, breakout direction, and time frame matter.

- It’s crucial to distinguish it from similar patterns like bear flags, downtrends, or double tops.

- Avoid the most common mistakes by planning trades with discipline and structure.

At Maverick Currencies, we believe in empowering traders with high-level strategy and discipline. If you’re ready to stop guessing and start trading with confidence, our team can help.

Ready to take your trading to the next level? Book a free call with one of our professional trading coaches and learn how Maverick can help you scale your capital, sharpen your edge, and trade like a professional.

Click here to schedule your call